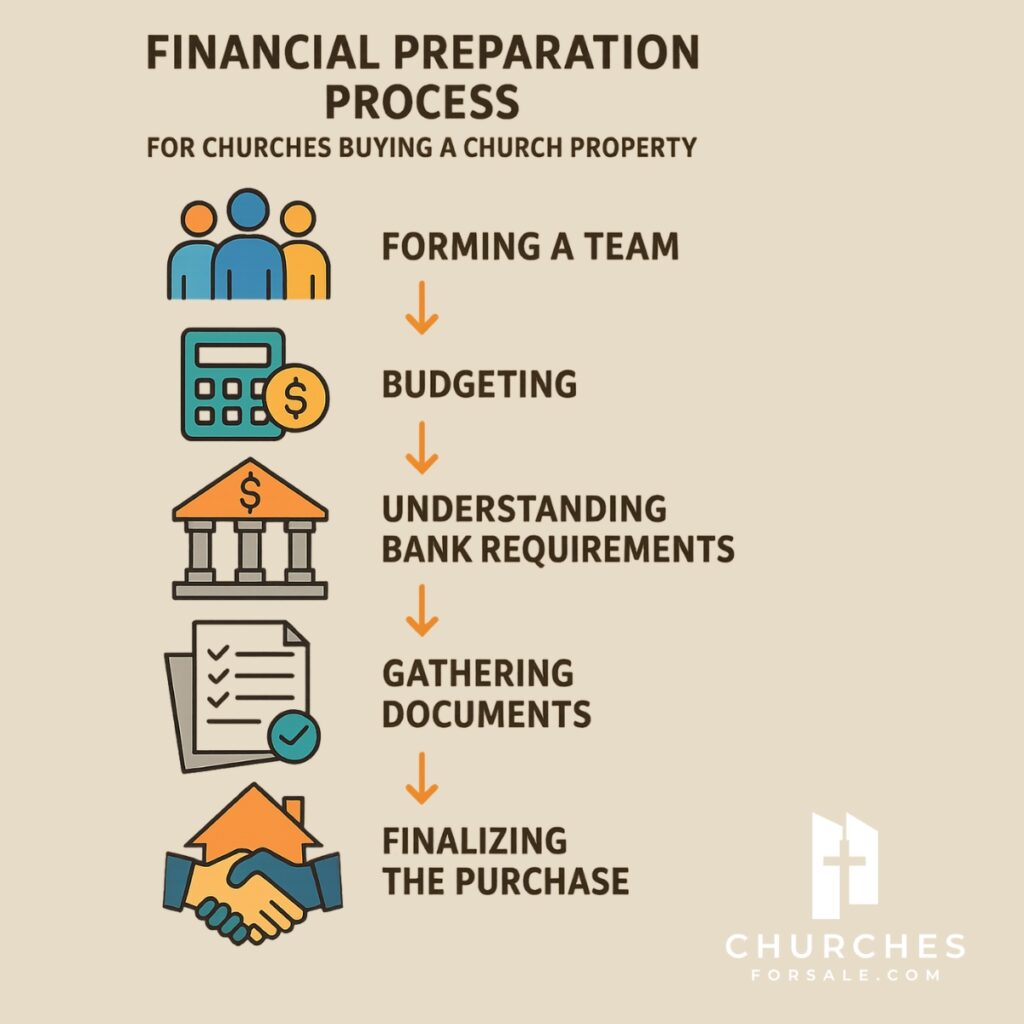

Financial Steps for Church Buying a Church Property: What church leaders need to know

What Are the First Financial Steps for a Church Buying a Church Property?

For churches in Arizona, Oregon, Texas, or Oklahoma (or any other state) buying a church property begins with understanding your mission, clarifying your budget, and mapping out the financial path from discernment to decision. First, church leaders need to form a core team to guide the process, including financial stewards, legal counsel, and local real estate professionals specializing in faith-based properties. Your articles of incorporation and bylaws will usually dictate who has legal authority to purchase property for the church, so check those early on.

Start by reviewing your budget. This means understanding exactly how much money your congregation has already raised, how much more you might feasibly raise, and what properties in your local area typically cost. Look at Arizona, Oregon, Texas, and Oklahoma markets to compare property values. Church properties in Phoenix or Dallas, for instance, may differ greatly from those in rural Oklahoma. Financial planning at this stage is essential and should include estimates for the down payment, escrow, and financing or loan payments as needed.

Definition of Terms:

Down Payment: A lump sum paid up front to secure the property. This is often 20-25% of the purchase price in church real estate transactions.

Escrow: Money held by a third party during the final stages of a property transaction to ensure all terms are met.

For a deeper dive into setting up your church’s real estate buying committee, read “Financing Options for Buying or Refinancing a Church Property” on ChurchesForSale.com.

Are you Ready to be a step ahead?

Years of Ministry and Administration leadership have connected Nate Bradley – CEO of Churches For Sale Group – to some incredible church lenders. Email Nate Directly to get connected with someone that can get your church on the path to financial stewardship.

How Do We Plan Our Church’s Finances and Prepare for Bank Requirements?

Churches often ask, “What do banks require for church real estate loans?” Each church should prepare at least three years of financial statements, including balance sheets (Statement of Financial Position), income statements, and evidence of fundraising success. Lenders will want to know your church’s history, leadership biographies, denominational background, and local connections in Arizona, Oregon, Texas, or Oklahoma. You’ll need data on regular giving units (committed donors), membership numbers, property appraisals, and project budgets.

Next, consider the property’s layout and features. Does it include a sanctuary, fellowship hall, classrooms, or office spaces? Understanding the full scope of what your property offers will help you highlight its strengths to potential buyers. Be sure to gather all relevant documentation, such as floor plans, maintenance records, and recent improvements.

Finally, review the location and surrounding area. Proximity to major roads, public transportation, and community amenities can all influence buyer interest. A well-located church property is often more attractive to a wider range of buyers, including other congregations, nonprofits, or even developers looking for unique spaces.

Local lenders in areas such as Phoenix, Portland, Dallas, or Oklahoma City may have different thresholds for minimum loan amounts and down payment ratios, but expect to provide information on your ministry’s financial stability, growth strategies, and community impact. In Arizona, for example, some lenders require a minimum loan amount of $500,000 and up to 25% down. We have a good list of Church lenders, as many lenders are hesitant to working with churches because of the potential of foreclosure. No lender wants to foreclose on a church and have that PR disaster.

Definition of Terms

Balance Sheet: The non-profit and church world you will also see the name of STATEMENT OF FINANCIAL POSITION, so please know those are interchangeable. A report showing what your church owns (assets – cash, property/equipment, etc), what it owes (liabilities – Debt, payables, etc.), and the net assets (equity). Net Assets are similar to the Owners Equity in a for profit organizaiton. Since there are no owners of a non-profit or church this is just a “NET’ of your assets and liabilities.

Income Statement: A summary of all income (offerings, donations) and expenses (staff, maintenance) over a set period.

Learn More: Church CFO

Did you know that we offer Fractional CFO services? What is that? Learn more here in this article we wrote about it.

Long story short. We can work with your book-keeper or church administrator, your senior leadership and elders to know what your finances mean for the future, not just a look at the past or a look at the present. How are you strategically looking at your church finances to Steward all that has been entrusted to you?

What Are the Key Financial Indicators Banks Use to Evaluate a Church Real Estate Loan?

Banks reviewing church real estate loans use several financial ratios. Debt Coverage Ratio (DCR), Loan-to-Value Ratio (LTV), and Debt-to-Income Ratio are standard measures. The DCR evaluates whether your church’s annual income can cover its expenses and proposed loan payments, while LTV compares the amount you want to borrow against the appraised value of the property.

Strong, stable giving from your members and a history of prudent financial management are crucial in all four states. Banks may also want to see proof of property insurance, title insurance, facility inspections, zoning approvals, and legal documentation proving your church has authority to buy or borrow (including articles of incorporation and bylaws).

Definition of Terms

Debt Coverage Ratio (DCR): Measures whether you have enough income to cover debt payments. A ratio above 1 means income exceeds debt costs.

Step-by-Step Calculation:

Determine Net Operating Income (NOI):

Add up all revenue sources (offerings, donations, rental income, etc.) for a year.

Subtract all operating expenses (salaries, utilities, maintenance, insurance, but NOT loan payments).

Formula: NOI = Total Income − Operating Expenses

Find Annual Debt Service:

This is the total amount your church pays in principal and interest on its loans each year.

Include all existing debt payments and anticipated payments for the new loan.

Calculate the Ratio:

Divide Net Operating Income by Annual Debt Service.

Formula: Net Operating Income / Annual Debt Service = Debt Coverage Ratio

Example Calculation:

Suppose your church’s NOI is $120,000 per year.

Annual debt service (loan payments) is $80,000.

DCR = 120,000 ÷ 80,000 = 1.5 DCR

A DCR of 1.5 means your church earns 1.5 times the income required to cover debt payments (banks usually require a DCR of at least 1.2–1.25).

Loan-to-Value Ratio (LTV): The percentage of the loan compared to the property’s total value. Most lenders prefer an LTV under 75% for churches.

Step-by-Step Calculation:

Determine Loan Amount:

This is the mortgage or loan your church is applying for, or has been approved for.

Find Appraised Property Value:

The value assigned by a professional appraiser for the property you want to purchase or refinance.

Calculate the Ratio:

Divide the loan amount by the property value, then multiply by 100 to get a percentage.

Formula: LTV = Loan Amount / Appraised Property Value × 100

Example Calculation:

Suppose your church seeks a loan of $600,000.

The appraised property value is $800,000.

LTV=(600,000÷800,000)×100=75%LTV=(600,000÷800,000)×100=75%

A 75% LTV means the loan covers 75% of the property’s value; most banks prefer LTVs of 75% or lower for churches.

What Unique Challenges Should Churches Anticipate in Arizona, Oregon, Texas, or Oklahoma (among other states)?

Each region brings nuances—zoning laws, property types, and local real estate markets affect both cost and process. For example, recent property values in Phoenix show rapid growth, while communities in rural Oklahoma may offer more affordable options but have different zoning codes.

You’ll face unique local concerns, such as environmental inspections in Oregon, mineral rights in Texas, or floodplain issues in Arizona. Churches must also plan for property appraisals, environmental reviews, and feasibility studies specific to local regulations.

Definition of Terms

Definition of Terms:

Appraisal: Professional assessment of property’s fair market value.

Zoning Approval: Confirmation from local authorities that a property can be used as a church.

Go Deeper - Continue your Learning Journey

Are you ready to learn more about Zoning issues that impact church properties?

Check out our article Understanding Zoning Laws for Church Real Estate.

How Can Church Leaders Improve Stewardship and Ease the Loan Process?

Transparency and planning are stewardship’s best friends. Share financial reports and plans regularly with congregation members, welcome questions, and make sure all stakeholders understand key terms and ratios. Build strong partnerships with local real estate professionals experienced in church property, especially those in Arizona, Oregon, Texas, and Oklahoma. ChurchesForSale.com has church real estate specialists that truly understand church property real estate and are ready to help you steward the resources that have been entrusted to you.

Encourage ongoing financial literacy education for board members and staff, and consult with outside experts to ensure compliance with state and federal guidelines.

Conclusion: Stewardship for Today and Tomorrow

Preparing your church to buy property in Arizona, Oregon, Texas, or Oklahoma (or any state) demands a team effort, solid planning, and full understanding of each financial step and term. By knowing what banks require and how local details affect the process, you set your ministry up for wise stewardship and long-term growth.

Every step of the way budgeting, assembling documentation, meeting local requirements, and educating your finance team leads to a stronger, more sustainable future. A future that builds trust and transparency with your church members whom you are calling on to steward their resources well.